Cant Logon to Citizen Bank Again

Personal Checking Accounts

The right checking account puts you in control

Free

Brand life easy with our simplest personal checking account.

Premier

Go the upgrade with the personal checking account that pays y'all interest.

Prestige

Sign upwardly for the VIP feel—an interest-bearing personal checking business relationship with the best features.

Answer a few questions to find the correct checking account

Payments & Transfers

Instantly move your money wherever you need it

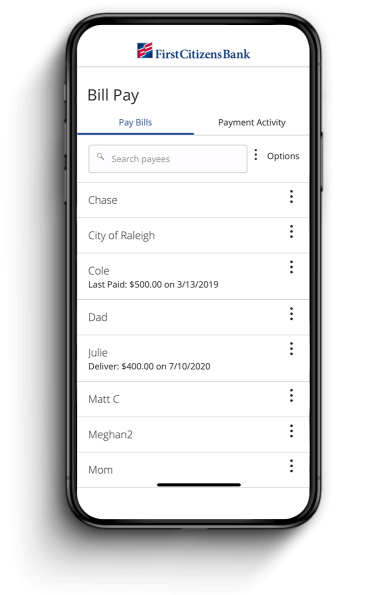

Pay your bills from any device

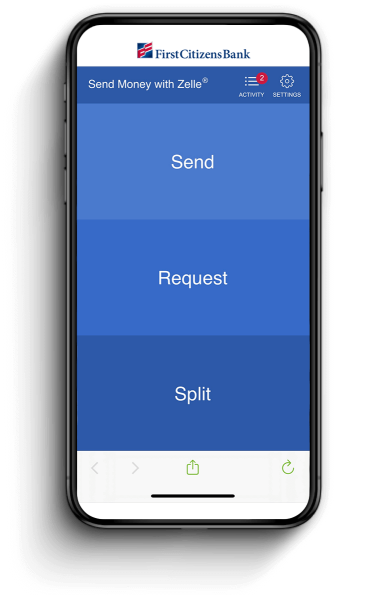

Send coin with Zelle®

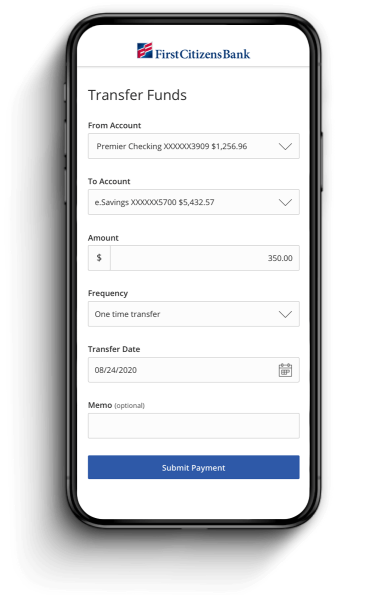

Transfer funds to other accounts

Payments & Transfers

Instantly move your money wherever y'all need it

Pay your bills from any device

Payments & Transfers

Instantly move your coin wherever you need it

Send money with Zelle®

Payments & Transfers

Instantly motion your money wherever yous need it

Transfer funds to other accounts

Explore proactive protection tools that can help yous track and manage your moneyD

Earn more than rewards every day

Get more points on everyday spending categories similar groceries, gas and streaming services.

Meeting the needs of those who we serve

Our armed services accounts help you manage your financial life from anywhere your job takes you.

Security

The aforementioned secure banking you've come to rely on us for in person, online

Security Alerts

We'll automatically send you alerts if your account credentials change.

Carte Freezes

Temporarily freeze or unfreeze your carte if it's lost or stolen, or if you suspect fraud.

Advanced Security

Rest assured that all your confidential account information is protected.

Insured

Your money is insured past the Federal Deposit Insurance Corporation.

Learn more about our privacy and security

Account openings and credit are discipline to bank approval.

For complete list of business relationship details and fees, come across our Personal Account Disclosures.

Zelle® and the Zelle® related marks are wholly owned past Early Alarm Services, LLC and are used herein under license.

Paperless statements are required. To be eligible for Costless Checking, you lot must sign up to receive First Citizens paperless statements within 60 days of business relationship opening. If you do not sign upwards and receive paperless statements, your account will be converted automatically and without prior find to you to a Select Checking account and will be subject to the fees and charges applicative to a Select Checking account. The applicative fees and charges volition be debited from your account without further notice to you and volition appear on your account statement. If you overdraw your account, fees may utilise. Refer to our Personal Account Disclosures for full details.

For current rates, delight phone call or visit your local branch.

Avoid the $18 monthly fee when yous meet any one of these criteria: $five,000 combined daily residual on select accounts (Premier Checking, Together Card, Regular Savings, Bonus Savings, Online Savings, Tiered Money Market Savings, Premium Tiered Coin Market Savings, CDsouth, IRAsouthward or an Investor Services Business relationship), at to the lowest degree $4,000 in monthly ACH straight deposits, EquityLine of at to the lowest degree $25,000, or $10,000+ original consumer loan (new or used auto, light or heavy truck, gunkhole, aircraft, unsecured personal loan, or mortgage [excludes mortgages that First Citizens does not retain servicing]).

Avert the $25 monthly fee when you lot meet whatever one of these criteria: $25,000 combined daily remainder on any Commencement Citizens eolith business relationship (Prestige Checking, Together Card, Regular Savings, Bonus Savings, Online Savings, Tiered Money Market Savings, Premium Tiered Money Market Savings, CDs, IRAs or an Investor Services Account), at least $half dozen,500 in monthly ACH direct deposits, EquityLine of at least $100,000, $25,000+ original consumer loan (new or used machine, light or heavy truck, boat, aircraft, unsecured personal loan, or mortgage [excludes mortgages that Showtime Citizens does not retain servicing]).

First Citizens Banking company will charge you up to $36 each time we pay an overdraft, upwardly to our limit of iv (iv) overdraft charges per business organization mean solar day. Nosotros will not charge you for overdrafts caused by transactions of $5.00 or less. Y'all are obligated to pay overdrafts immediately. We pay overdrafts at our discretion. If we practise not choose to pay your overdraft, the transaction will be declined. Consumers are responsible for the repayment of overdrafts and have the selection to decline this service. Overdraft protection is non available on the Together Card. Please encounter our Deposit Account Understanding for boosted details.

Links to 3rd-party websites may accept a privacy policy dissimilar from Showtime Citizens Bank and may provide less security than this website. First Citizens Banking concern and its affiliates are non responsible for the products, services and content on any third-party website.

Depository financial institution deposit products are offered past Commencement Citizens Banking company. Member FDIC and an Equal Housing Lender. icon: sys-ehl.

Source: https://www.firstcitizens.com/personal/checking

Enregistrer un commentaire for "Cant Logon to Citizen Bank Again"